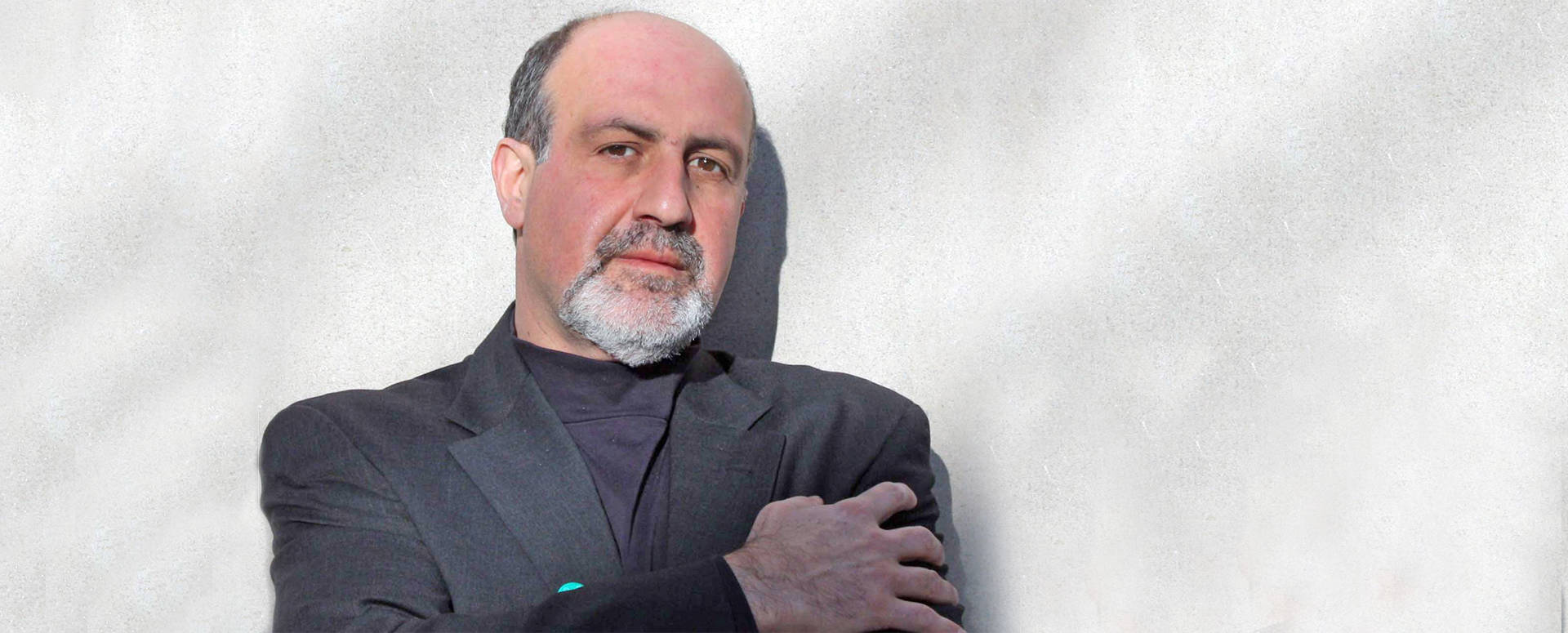

Nassim Nicholas Taleb

Best-Selling Author of The Black Swan: The Impact of the Highly Improbable

Nassim Nicholas Taleb

Best-Selling Author of The Black Swan: The Impact of the Highly Improbable

Biography

Nassim Nicholas Taleb spent 21 years as a risk taker (quantitative trader) before becoming a researcher in philosophical, mathematical and (mostly) practical problems with probability.

Taleb traveled the conventional route of education to real-life and theory to practice in inverse sequence from the common one, moving from the practical to the philosophical to the mathematical. He started as a trader, then got a doctorate in mid-trading career; he wrote literary books before writing technical papers, and his work became progressively more technical and formal with time.

Taleb is the author of a multivolume essay, the Incerto (The Black Swan, Fooled by Randomness, Antifragile, and Skin in the Game) covering broad facets of uncertainty. It has been published into 41 languages.

In addition to his trader life, Taleb has also written, as a backup of the Incerto, more than 70 scholarly papers in mathematical statistics, quantitative finance, statistical physics, philosophy, ethics, economics, & international affairs, around the notion of risk and probability (grouped in the Technical Incerto).

Taleb is currently Distinguished Professor of Risk Engineering at NYU's Tandon School of Engineering (only a quarter time position) and scientific advisor for Universa Investments. His current focus is on the properties of systems that can handle disorder ("antifragile").

Taleb refuses all honors and anything that "turns knowledge into a spectator sport."

)

)

)

)